Some Known Questions About Fortitude Financial Group.

Some Known Questions About Fortitude Financial Group.

Blog Article

Fortitude Financial Group - Truths

Table of ContentsThe Fortitude Financial Group StatementsThe Facts About Fortitude Financial Group UncoveredGetting My Fortitude Financial Group To WorkFascination About Fortitude Financial GroupFortitude Financial Group Fundamentals Explained

In a nutshell, an economic consultant assists individuals handle their cash. Generally, there is an investing element to their services, but not always. Some monetary consultants, commonly accounting professionals or attorneys who concentrate on trusts and estates, are riches managers. Among their key functions is safeguarding customer riches from the IRS.Normally, their focus is on informing clients and supplying threat management, money flow analysis, retired life preparation, education and learning planning, investing and a lot more. Unlike lawyers that have to go to law institution and pass the bar or medical professionals who have to go to medical institution and pass their boards, economic consultants have no particular special demands.

Typically, though, a economic expert will certainly have some sort of training. If it's not with an academic program, it's from apprenticing at a monetary advising firm (Investment Planners in St. Petersburg, Florida). People at a firm that are still learning the ropes are typically called affiliates or they become part of the administrative team. As kept in mind previously, though, lots of experts originate from various other fields.

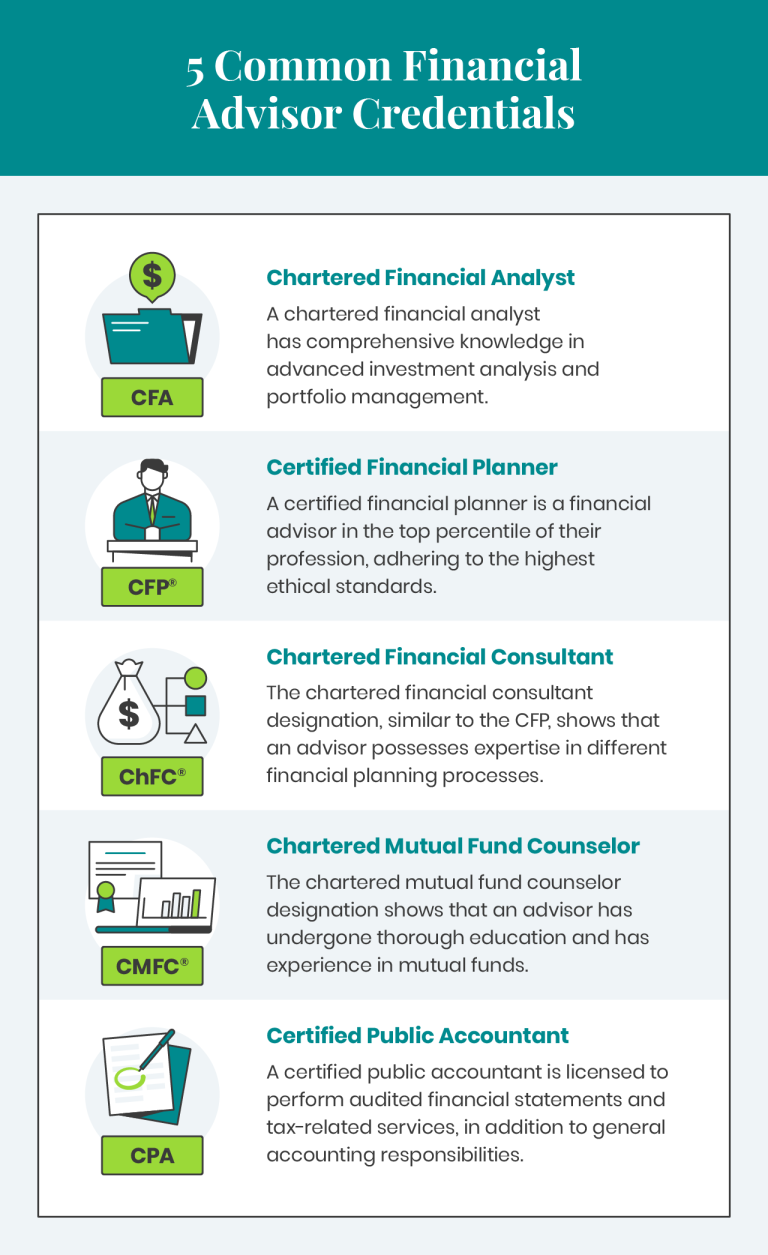

Or maybe someone who manages possessions for a financial investment firm chooses they prefer to assist people and service the retail side of the company. Many financial consultants, whether they currently have professional levels or not, undergo qualification programs for even more training. An overall financial consultant certification is the certified monetary planner (CFP), while an innovative version is the chartered financial specialist (ChFC).

Fortitude Financial Group Can Be Fun For Anyone

Normally, an economic expert supplies financial investment monitoring, financial planning or wide range monitoring. This can be on an optional basis, which indicates the consultant has the authority to make professions without your authorization.

It will information a collection of actions to require to achieve your economic objectives, consisting of a financial investment strategy that you can carry out on your very own or if you want the expert's assistance, you can either hire them to do it as soon as or register for ongoing monitoring. Financial Advisor in St. Petersburg. Or if you have details requirements, you can work with the expert for economic preparation on a job basis

Fortitude Financial Group for Dummies

This implies they must place their clients' finest passions prior to their own, among other things. Various other financial experts are participants of FINRA. This often tends to indicate that view website they are brokers who additionally offer investment recommendations. As opposed to a fiduciary criterion, they have to comply with Policy Best Passion, an SEC guideline that was established in 2019.

Their names commonly state all of it: Stocks licenses, on the various other hand, are much more about the sales side of investing. Financial consultants that are also brokers or insurance coverage agents tend to have securities licenses. If they straight buy or sell stocks, bonds, insurance coverage products or provide financial guidance, they'll need certain licenses connected to those products.

A Collection 6 certificate permits a monetary expert to market investment items such as common funds, variable annuities, device financial investment depends on (UITs) and some insurance coverage items. The Collection 7 license, or General Stocks license (GS), enables an expert to sell most types of safety and securities, like usual and favored stocks, bonds, alternatives, packaged investment products and more.

3 Easy Facts About Fortitude Financial Group Explained

Constantly make sure to ask regarding monetary experts' charge schedules. A fee-only expert's sole form of payment is through client-paid fees.

When trying to recognize just how much a monetary advisor prices (St. Petersburg Investment Tax Planning Service), it's essential to understand there are a range of compensation techniques they might use. Here's a review of what you might face: Financial consultants can make money a portion of your total assets under monitoring (AUM) for handling your money.

Based upon the previously mentioned Advisory HQ research, prices usually range from $120 to $300 per hour, often with a cap to just how much you'll pay in total amount. Financial advisors can obtain paid with a fixed fee-for-service version. If you desire a fundamental economic strategy, you could pay a flat fee to obtain one, with the Advisory HQ study highlighting ordinary prices differing from $7,500 to $55,000, depending upon your possession tier.

More About Fortitude Financial Group

When an advisor, such as a broker-dealer, offers you a monetary product, he or she obtains a specific percent of the sale quantity. Some monetary consultants that function for large brokerage firm firms, such as Charles Schwab or Integrity, get an income from their company.

Report this page